- Check Status

Protect Your Savings with GAP Coverage

Avoid financial stress if unexpected events happen to your vehicle

What is GAP Coverage?

Think of GAP (Guaranteed Asset Protection) as a safety net for your car loan. It’s like insurance, but it protects you from owing money on your loan if your car is totaled or stolen.

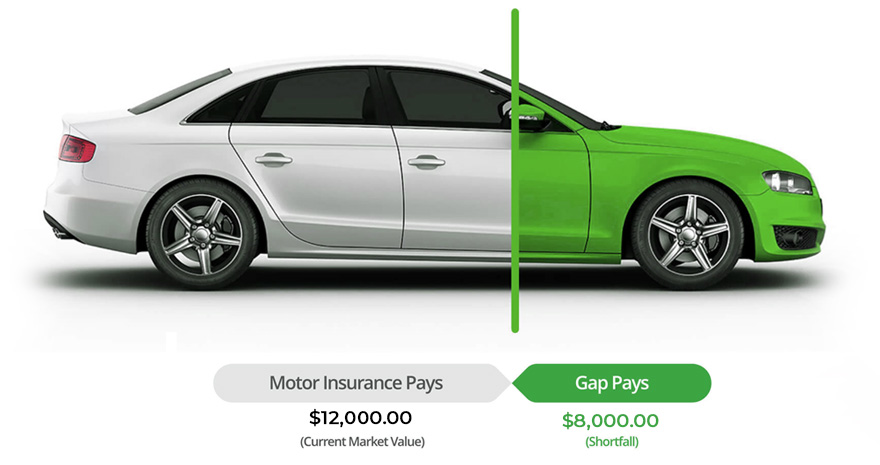

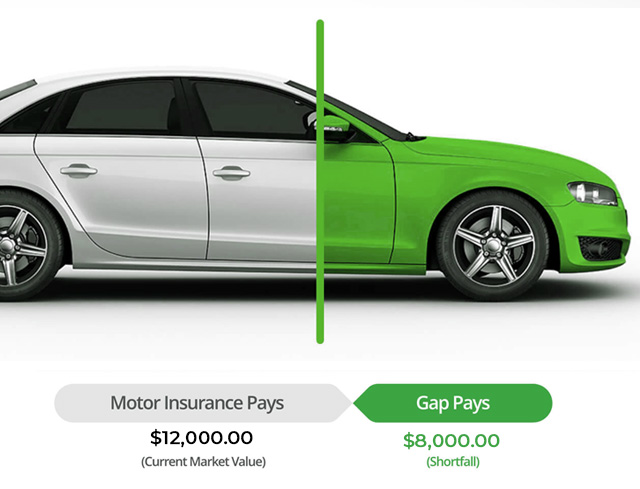

Here’s how it works: If your car is a total loss, your primary insurance will pay you the current market value of your car. But, you might still owe more on your loan than what the car is worth. This is where GAP coverage comes in. It covers the difference between what you owe and what your insurance pays, up to $50,000.

Why Do You Need GAP Coverage?

Cars depreciate quickly. This means the value of your car goes down over time. But the amount you owe on your loan might stay the same or even go up. GAP coverage protects you from this potential financial burden.

GAP Coverage Benefits

- Provides all-risk protection

- Paid over the life of your auto refinance loan

- Minimal restrictions

- Protection Plus option pays $1,000 toward your insurance deductible and provides a full refund of the GAP waiver if your vehicle is totaled (not available in all states)

- Like insurance, but less expensive

Ready to Start Saving?

Complete our fast and easy application now and get a no-obligation quote today. We’ll find the best rate and payment options. Our team of Refi Savings Experts will help you lock in loan terms that meet your needs.

Real Customers. Real Savings!